5 November 2020. By our corporate partner Sunsuper.

You work hard for your money, and your super can work hard for you through the power of compound investment earnings.

Dropping additional contributions into your super is like throwing stones into a pond. The earnings on your investment options stay invested, and as they generate earnings, they create a ripple effect that can grow your super balance.

Contributions from your employer alone may not be enough to fund your dream retirement and if you’re able to make additional contributions now, the ripple effect of compounding investment earnings can help you prepare for the years ahead.

Ever wondered what difference making additional contributions, even in small amounts, could make to your retirement?

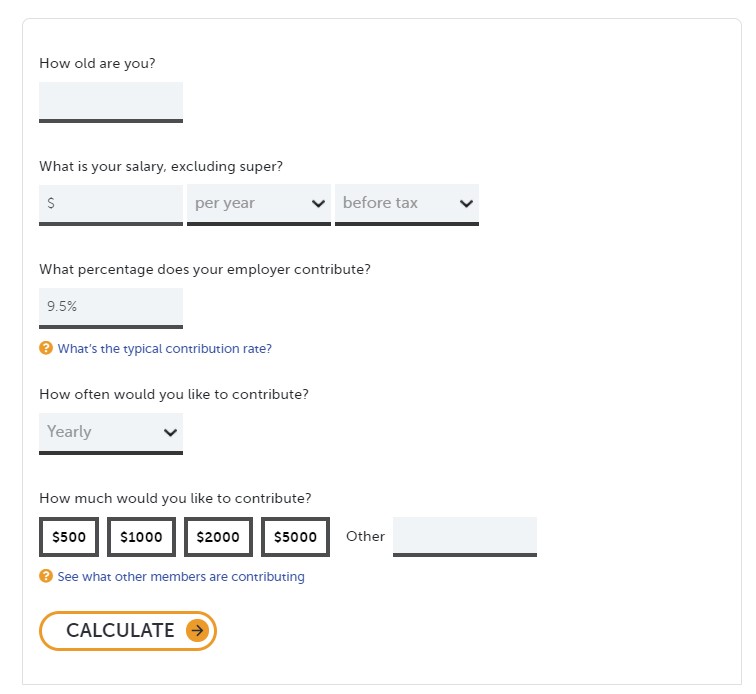

Check out our Superannuation Contributions Calculator – an easy-to-use tool where you can play with different contribution amounts, no matter how small (starting at $1) and see what the tax benefits might be if you added a little extra into your super.

The sooner you start to contribute, even in small amounts, the harder your investment earnings can be working for you.

Want to know about other ways you can grow your super? Check out other great tools and resources available on our Sunsuper website.

- Voluntary after-tax contributions – find out about after-tax contributions you can make on a one-off or regular basis, whatever suits you.

- Salary sacrifice – learn about pre-tax contributions which can be set up through your employer with potentially great tax benefits.

- Salary sacrifice email template– not sure what information is required to set up a salary sacrifice agreement with your employer? Take a look at our sample email template for employees.

- Request a call back from a Sunsuper financial adviser – talk to a financial adviser about your Sunsuper account at no additional cost. This over-the-phone service is covered through your Sunsuper membership admin fees.

To find out more about the ripple effect of compound investment earnings, go to sunsuper.com.au/additional-contributions

Start making a real difference to your retirement today. Contact us on 13 11 84 between 8.00am to 6.30pm (AEST) Monday to Friday or visit sunsuper.com.au/choose

To read other Sunsuper articles, visit our Knowledge Centre

Disclaimer

This article has been prepared and issued by Sunsuper Pty Ltd, (ABN 88 010 720 840, AFSL No. 228975) the trustee and issuer of the Sunsuper Superannuation Fund (ABN 98 503 137 921, USI 98 503 137 921 001). It contains general advice and does not take into account the investment objectives, financial situation or needs of any particular individual. You should consider if the advice is appropriate to your own circumstances before acting on it. Outcomes are not guaranteed. Past performance is not a reliable indication of future performance. Sunsuper employees provide advice as representatives of Sunsuper Financial Services Pty Ltd (ABN 50 087 154 818 AFSL No. 227867) which is wholly owned by the Sunsuper Superannuation Fund. Visit sunsuper.com.au or call 13 11 84 for a copy of the PDS.